is an inheritance taxable in michigan

Only a handful of states still impose inheritance taxes. Inheritances are not considered income for federal tax purposes whether you inherit cash investments or property.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993.

. Federal Death Tax After much uncertainty Congress stabilized the Federal Estate Tax also. However if the inheritance is considered income in. However any subsequent earnings on the inherited.

Michigan does not have an inheritance tax with one notable exception. For most people there is no concern about Michigan estate or death taxes. However any subsequent earnings on the inherited.

The State of Michigan does not. This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable. What is the inheritance tax in Michigan.

The state repealed those taxes in 2019 and so it leaves families or survivors of individuals without those. Whether estate or inheritance taxes are applicable depends on which state the decedent lived in. Regarding your question Is inheritance taxable income Generally no you usually dont include your inheritance in your taxable income.

Michigan does not have an inheritance tax or estate tax on a decedents assets. You can elect to take a. There is no federal inheritance tax but there is a federal estate tax.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Inheritance tax is levied by state law on an heirs right to receive property from an estate.

Michigans estate tax is not operative as a result of changes in federal law. I will be splitting it with my sisters. Inheritance taxes and estate taxes are common but not required by every state.

As a result the Michigan Inheritance Tax is only applicable to people who inherited from a person. Your inheritance can actually be taxed in two ways. The tool is designed for taxpayers.

As a result the state has no cap on inheritance. When you inherit an annuity the payments you receive are taxed the same way. Is there still an Inheritance Tax.

What is Michigan tax on an inherited IRA Mom recently passed and left an IRA with me listed as beneficiary. Inheritance taxes and estate taxes. Inheritances are not considered income for federal tax purposes whether you inherit cash investments or property.

In Michigan as in most states a person can only inherit 5000 in value at a time and the states inheritance tax is 15. Its applied to an estate if the deceased passed on. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today.

The short answer is yes an inheritance may be taxable depending on a few factors. As of the time of publication the top federal tax bracket is 37 percent. Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who died on or before September 30.

An inheritance tax is a levy. Mom had opted to have federal.

Federal And Michigan Estate Tax Amounts On Inheritances

Michigan Rules Of Intestate Succession Atlas Law

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Inheritance Tax Explained Rochester Law Center

State Estate And Inheritance Taxes Itep

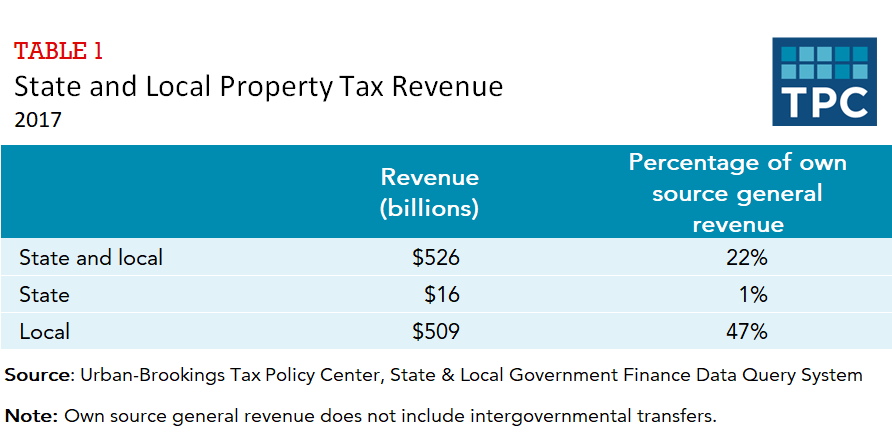

How Do State And Local Property Taxes Work Tax Policy Center

Do I Need To Hire A Probate Lawyer Michigan Estate Planning

Michigan Inheritance Laws What You Should Know Smartasset

Disclaiming An Inherited Gift In Michigan Resnick Law P C

State Death Tax Hikes Loom Where Not To Die In 2021

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Where Not To Die In 2022 The Greediest Death Tax States

Michigan Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Estate Planning Update Financial Planning Association

What Taxes Are Associated With An Inheritance Rhoades Mckee

State Estate And Inheritance Taxes Itep

Will You Ever Need To Pay An Inheritance Tax In Oklahoma Oklahoma Estate Planning Attorneys

How Do State And Local Property Taxes Work Tax Policy Center